Experts in gathering R&D project details & writing robust case studies for R&D tax credit claims

Any business making an R&D tax credit claim in the UK needs to understand the HMRC guidelines as to what does and doesn’t qualify as R&D for tax purposes, and how the guidelines relate to their industry and what they do specifically. It is also increasingly important to provide strong evidence to support a claim submission in the form of a case study – and HMRC’s recently introduced “Additional Information Form”. Accounting firms are not always well placed to “talk tech” with their clients’ technical specialists, and claimants are rarely experts in the R&D tax credit guidelines. That’s where we can help by being the bridge between accountants / tax advisors and their clients (claimants).

Our small team of consultants and technical writers specialise in helping businesses navigate the complex world of R&D tax claims. With our expertise, we ensure that businesses can maximise their eligible claims with a robust technical claim and help them to receive the financial benefits they deserve. Our interviews with the company’s experts (what HMRC term the “competent professionals”), our technical writing services and enquiry support provide hand-holding support for R&D tax credit claims.

Providing a comprehensive suite of technical services

✩ Meetings with technical specialists (“competent professionals”) of claimant businesses

✩ Qualifying R&D projects & activities

✩ Review of information & case studies

✩ Help company specialists to understand the guidelines as they relate to their sector and the work they are doing

✩ Author case studies for submission alongside the claim

✩ Support with HMRC enquiries including formal documentation

✩ Training to accountancy firms to up-skill their team to more effectively have conversations with their clients’ competent professionals

Consultancy from industry experts across diverse fields

Software & digital

Software engineering, software product & service development, software houses, digital agencies, AI & machine learning, hardware, communications & networking, ecommerce, fintech, blockchain

Engineering

Mechanical, electrical, chemical, civil, marine, industrial, product development, manufacturing, automotive, robotics

Scientific research

Medical, pharmaceutical, health, materials, environmental, data

Other fields

Construction, architecture, foodtech, agriculture / agri-tech, environmental & ecological

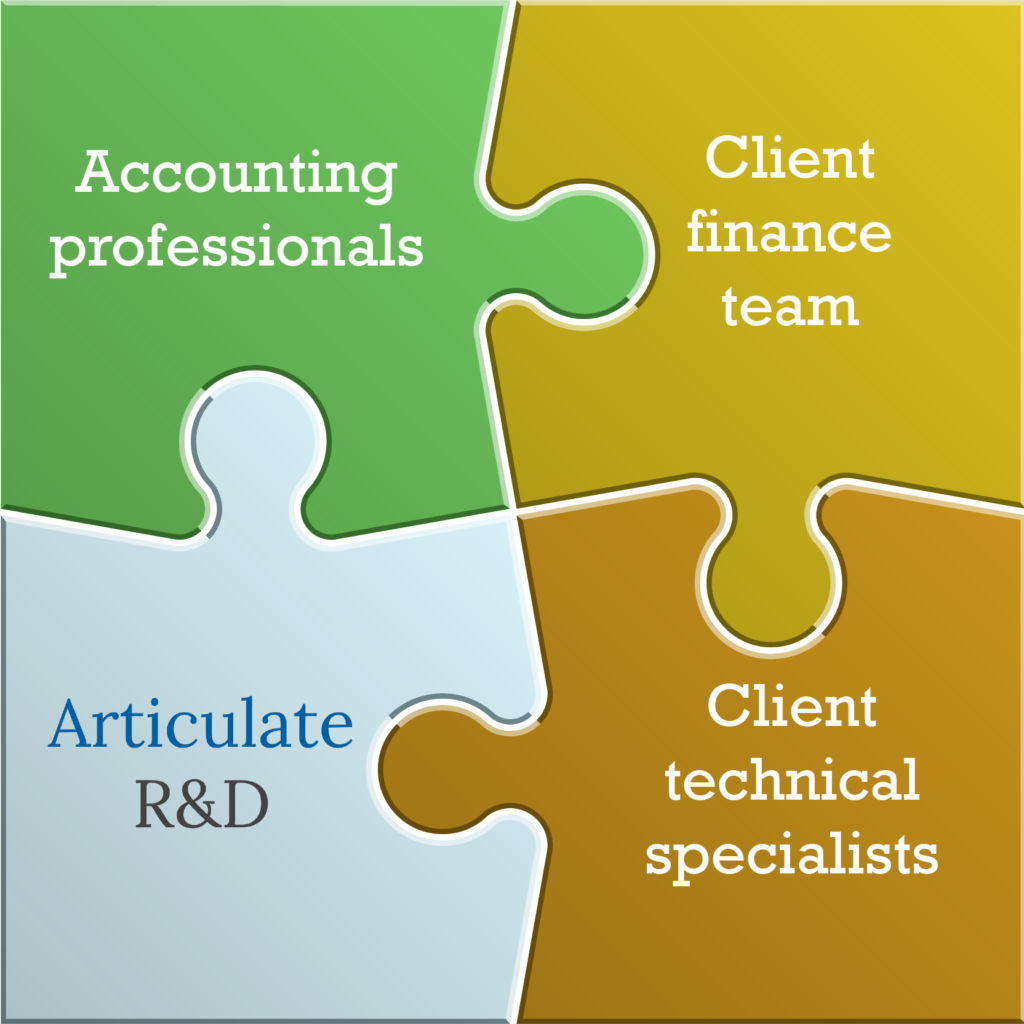

Working alongside claimants and accountants

Our clients include accountancy firms (large and small), R&D claims specialist firms, and claimant companies directly.

For our accountancy and R&D specialist clients, we work alongside their teams as their “industry experts” or “sector specialists”. Our focus is with liaising with the claimant’s experts (typically CTOs, engineers and scientists) to hand-hold them through the claim process, working closely with them to help them understand the rules and guideline of HMRC’s schemes, and obtaining the required information from them.

Working directly with claimant businesses, we typically work with their experts, and closely alongside their finance team and/or accountants, supporting the claim process. We also offer advice where a business has questions that they don’t feel are being answered by their accounts / R&D claim provider – we can give an independent opinion on your claim, process, and support in HMRC enquiries.